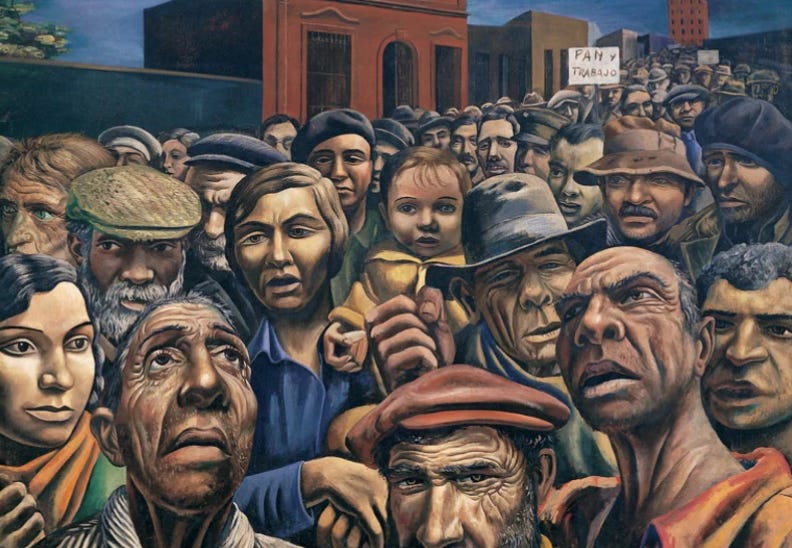

Argentina: Demonstration effect.

Also: Israel, Yemen, Ukraine, Russia, the South China Sea and Taiwan.

ARGENTINA. Demonstration effect.

Hyperinflation leads to hyperpolitics.

Self-described anarcho-capitalist Javier Milei won 55.8% of Argentina's second-round presidential vote, authorities said late Sunday, with 93.4% of ballots counted. "I am very proud of you", Donald Trump told Milei on social media.

INTELLIGENCE. Wielding a chainsaw in rallies and vowing a decisive break with the past, Milei will take power on 10 December. Yet he will immediately face a hostile legislature, even if he can build a working coalition with the centre-right, which endorsed his candidacy after the first round. He will also face a sceptical audience internationally, having described Joe Biden as a “socialist”, Brazil’s president as an “angry communist”, and Xi Jinping as an “assassin”.

FOR BUSINESS. Power usually has a sobering effect, but on Milei it may not, particularly if legislative constraints prevent him achieving his libertarian aims conventionally. Argentina’s dismal economy – where inflation hit 142.7% in October – needs reform, but a chainsaw is the wrong instrument. It is hard to see a path to improvement without further pain. It is also hard to see the Mercosur free trade area, let alone its mooted deal with Europe, surviving long.

Written by former diplomats and industry specialists, Geopolitical Dispatch gives you the global intelligence for business and investing you won’t find anywhere else.

ISRAEL. YEMEN. Red Sea, red flag.

Iran-backed militants seize a ship as a reprisal, and a warning.

Yemen's Houthi rebels seized a Bahamas-flagged cargo ship and its 25 crew on Sunday. The NYK Line-operated Galaxy Leader is registered in Britain but linked to billionaire Israeli car importer Rami Ungar, who has a fleet of similar vessels.

INTELLIGENCE. The Houthis, who control much of Yemen – including the Port of Hodeida, where the Galaxy Leader has been taken – targeted the ship as a show of support for Gaza amid domestic unease and halting peace talks with Saudi Arabia. Besides a few stray missiles, this support has largely been rhetorical, like Iran’s other proxies. Yet it is also a warning to shippers, whether in the Red Sea or Persian Gulf, of Tehran’s ability to disrupt global trade.

FOR BUSINESS. Iran is sending a message to the US, as well as Israel, that while oil prices are at recent lows, Tehran can upend markets and damage Western unity, which for it is a bigger concern than Gaza’s plight. Front of mind is its recently extended US sanctions waiver to purchase Iraqi electricity, which has attracted condemnation from Republicans, but which Tehran needs to manage inflation, now at a two-year high of 54.8%, ahead of the winter.

With the brevity of a media digest, but the depth of an intelligence assessment, Daily Assessment goes beyond the news to outline the implications.

UKRAINE. RUSSIA. Black Sea, black hole.

Missing ships and angry truckers complicate Ukraine’s exports.

Ukraine had an advantage over Russia in the Black Sea, Volodymyr Zelensky said on Thursday. A Turkish cargo ship sank amid a storm on Sunday. A bulk carrier loaded with wheat was damaged by a floating sea mine on Thursday.

INTELLIGENCE. Kyiv can’t control the weather, but the latest incident raises fresh questions over maritime safety. Though Ukraine claims 151 ships have used its corridor to Odesa since Russia pulled out of UN-backed arrangement, there have been several incidents since August. On land, trade has been complicated by a Polish truck strike, which Slovakian drivers threatened to join last week. 40-hour queues have formed at the border since 6 November.

FOR BUSINESS. There is undoubtedly Russian involvement in the trade dispute, but Zelensky also faces enemies within as the war grinds to a stalemate. Kyiv claimed last week a 'Maidan 3' counter-revolution was being planned. Splits are reported within Zelensky's inner circle. Russia's economy meanwhile grew at 5.5% in the third quarter. Indications of sanctions busting abound, including Russian real estate deals in Spain hitting a post-2014 high.

SOUTH CHINA SEA. Dredging up the present.

A repeat lesson in history and geography.

The Philippines’ president said on Sunday Manila sought new alliances to check China's ambitions. Ferdinand Marcos earlier met Xi Jinping on Friday. Vietnam had ramped up dredging in the Spratly Islands, a think tank said on Wednesday.

INTELLIGENCE. Wednesday’s report said since December, Hanoi had constructed almost three times the acreage as it had over the previous ten years. Manila has been less ambitious in its island-building but has doubled-down on provisioning a WWII-era wreck it uses as a forward base, and on engaging the US and its allies in regional exercises. Meetings at APEC were designed to diffuse tensions with China, but on the water, relations remain all at sea.

FOR BUSINESS. Nobody in the South China Sea wants war, but everyone is trying to establish facts on the ground (or ocean) before elections in 2024 change the calculus. In the meantime, island building by Vietnam makes it harder for the West to ask China not to do the same. And risky manoeuvrers by Filipino vessels neutralise criticism of China’s aggressive conduct. Manila is now reportedly seeking a separate code of conduct with claimants excluding Beijing.

Emailed each weekday at 5am Eastern (9am GMT), Daily Assessment gives you the strategic framing and situational awareness to stay ahead in a changing world.

TAIWAN. Ko dependent.

Fractures in the opposition may forestall a chance for stability.

Talks between Taiwan opposition leaders Hou Yu-ih and Ko Wen-je were deadlocked on Sunday over who would contest January's election. Taipei reported renewed Chinese military activity on Sunday after a lull during the APEC summit.

INTELLIGENCE. Hou represents the main opposition Kuomintang party, but Ko has arguably a better chance of uniting the spectrum of opposition voters. The wildcard remains Foxconn billionaire Terry Guo, whom Ko met last night. Beijing’s resumption of military intimidation may concentrate minds, but ultimately a war remains unlikely. As Xi Jinping reportedly told Joe Biden at APEC last week, China has no plans to invade. But it does have plans to coerce.

FOR BUSINESS. For now, Beijing just wants Taiwan to be pliant (e.g. not pursue independence) and not complicate China’s economic recovery or global prestige. Most Taiwanese are probably okay with this but should a split form between Democrats and Republicans on the otherwise bipartisan issue of China, riskier positioning and rhetoric can be expected regardless of who governs in Taipei. Straight from meeting Xi, criticism began on Biden’s China policies.

Great piece! Don’t know much about Argentine politics or history but everything I’ve read about Milei sounds…worrisome.