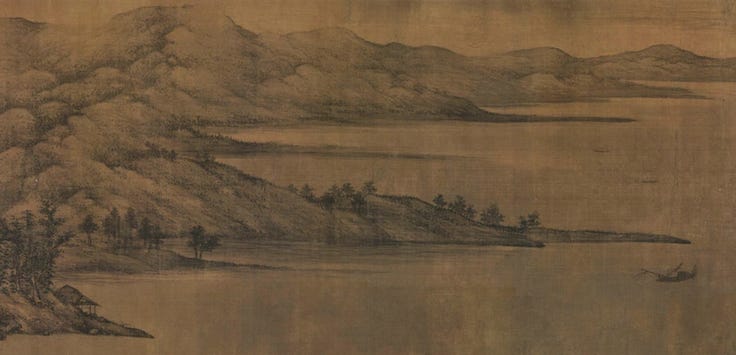

China: Slow boat.

Also: Russia, the UK, Lebanon, Myanmar and Bosnia.

CHINA. Slow boat.

Domestic growth continues to sputter.

China’s National Development and Reform Commission announced on Monday a series of measures to boost domestic consumption, including easier real estate and vehicle loans, and funding to support domestic tourism.

INTELLIGENCE. The measures are consumer-focused unlike previous stimulus efforts. China’s recovery from Covid continues to disappoint. Monday’s official manufacturing index came in at 49.3 in July (50 points signifies growth) and businesses shuttered by lockdowns have struggled to regain traction, while heat waves and torrential rain have impacted power to factories and crop yields. Youth unemployment remains significant at 21.3%.

FOR BUSINESS. The range of industries targeted is wide, but scattergun, with little detail and questionable impact. The measures stop short of genuine stimulus through infrastructure spending or tax cuts. Firms and investors, primed to expect government spending during a downturn, will be disappointed, while production curbs on steel-makers remain a counterweight. Steel-heavy property and associated industries comprise a third of China’s GDP.

CHINA. RUSSIA. Droning off.

Export bans highlight the sensitivity of dual-use technologies.

China on Monday announced new restrictions on the export of long-range civilian drones. It cited the war in Ukraine and its concerns that drones were being used for military purposes. Bans will be in place for “up to” two years.

INTELLIGENCE. The move comes as Russia shot down several more drones over Moscow on Monday – the fifth time since May the city’s airspace has been penetrated. Amid attempts at economic rapprochement with Washington, Beijing wants to be perceived as neutral, and the use by both Moscow and Kyiv of Chinese-made drones counters that narrative. The move might irk Moscow, but Beijing will find other ways to satisfy its “no limits” friend.

FOR BUSINESS. The export ban further demonstrates ongoing sensitivities in the trade of technology. In April, China imposed export controls on rare earths gallium and germanium, which are critical to the global chipmaking industry. The move followed US bans on Chinese companies buying chips and chip-making equipment without a licence. As the line between civilian and military technology becomes increasingly blurred, more items will be caught in the net.

Written by former diplomats and industry specialists, Geopolitical Dispatch gives you the global intelligence for business and investing you won’t find anywhere else.

BRITAIN. Eyes to the North.

The UK seeks to balance energy and climate commitments.

Downing Street said on Monday the UK would grant “hundreds” of new oil and gas licenses in the North Sea in pursuit of energy independence. The moves were opposed by climate groups, disappointed in Britain’s decarbonisation efforts.

INTELLIGENCE. Rishi Sunak said that up to 25% of Britain’s energy would still need to come from fossil fuels, even when net zero is achieved in 2050. While citing the need to reduce reliance on imported energy, support for the North Sea industry remains politically sensitive following a week of high temperatures attributed to climate change. Further, the move may ultimately promote Scottish secession, should Edinburgh’s coffers come to be refilled with oil revenue.

FOR BUSINESS. Sunak is trying to balance economic growth with climate commitments. The announcement included a vow to invest £20 billion in carbon capture and storage, which could support up to 50,000 jobs. But the drive is clear – the government wants less emphasis on the environment and more on blue-collar workers ahead of the next election. The North Sea isn’t what it once was. Of 283 active fields, 180 will likely be depleted by 2030.

LEBANON. Centrally unmanaged.

The central bank governor leaves under a cloud.

Lebanon's once-celebrated central bank governor, Riad Salameh, ended his 30-year tenure on Monday amid charges of money laundering and embezzlement. No permanent replacement has yet been identified.

INTELLIGENCE. Salameh started his tenure in 1993, a few years after Lebanon’s 15-year civil war. Tasked with rebuilding the economy, he was initially feted, with high-interest rates attracting money into Beirut. Now, however, he is better known for high inflation and corruption probes in France, Germany and Luxembourg. Despite this, Lebanon will likely protect him. A mainstay of the establishment, should he go down he would bring much of the elite with him.

FOR BUSINESS. Lebanon remains in a dire situation, yet to recover from the combined impacts of a 2019 political uprising, the Beirut port explosion, COVID-19 and a massive outflow of capital. The interim governor has proposed a six-month plan which includes capital controls and bank restructuring. But citizens continue to find access blocked to their bank accounts and a sustained drop in purchasing power. Salameh’s successor will have a hard road ahead.

With the brevity of a media digest, but the depth of an intelligence assessment, Daily Assessment goes beyond the news to outline the implications.

MYANMAR. Electing to delay.

The junta continues its state of emergency.

Myanmar’s military extended a state of emergency on Monday, further delaying elections that few thought would happen anyway. Media reported on Tuesday that Aung San Suu Kyi had been pardoned of five of 19 charges.

INTELLIGENCE. State media said the state of emergency would be extended by a further six months to allow greater time to prepare for elections. Yet this, and the release of Aung San Suu Kyi from prison to house arrest, is unlikely to portend a return to democracy. The junta is likely buying time. Having failed to quell unrest since retaking control in 2021, it needs to make token efforts to appease a disgruntled population.

FOR BUSINESS. Domestic resistance to the military continues to cause instability. Myanmar’s shattered economy looks no closer to recovery. On Monday, a bomb blast near the Thai border killed one and wounded 12 others. State-owned banks remain under sanctions. The black market continues to dominate trade. The military is betting that a managed election could ease its isolation and the opposition movement will peter out. Aung San Suu Kyi is 78.

BOSNIA. Secede to succeed?

Further agitation in the Balkans.

The US on Monday imposed sanctions against several Bosnian Serb politicians for undermining the Dayton Accords. Bosnia’s state court on Friday said it would ask Interpol to issue a warrant for a former commander linked to Srebrenica.

INTELLIGENCE. In June, lawmakers from the Serb region of Bosnia (Republika Srpska) voted to suspend rulings by Bosnia’s constitutional court, a key tenet of the Dayton peace agreement. The republic’s pro-Russian president had criticised the court for allowing decisions to be made without Serb judges. He and other top officials have long advocated Republika Srpska’s secession from the rest of Bosnia and its unification with Belgrade.

FOR BUSINESS. The Dayton peace agreement was always tenuous. Decades on, tensions in the former Yugoslav republics run high, with towns and regions still divided along ethnic lines. The divisions run into the economy too. Republika Srpska has regulatory independence, which means a lower unemployment rate, but fewer links into the EU market. Such conditions give local businesses a boost but entrench volatile politics and a crony capitalist mentality.

Emailed each weekday at 5am Eastern (9am GMT), Daily Assessment gives you the strategic framing and situational awareness to stay ahead in a changing world.