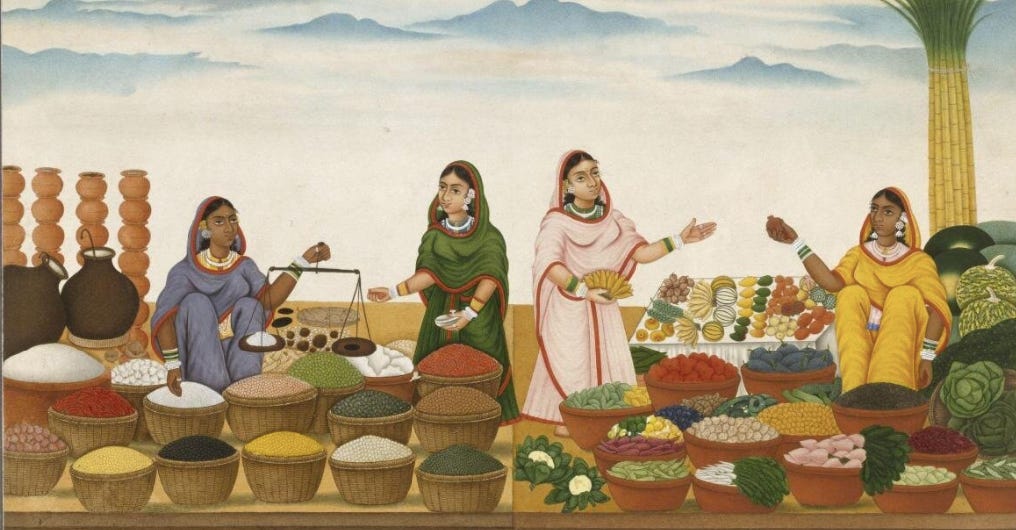

India: Food chain reaction.

Also: China, Taiwan, Europe, the Sahel and Vanuatu.

INDIA. Food chain reaction.

Delhi brings in more export controls.

India expanded rice trade restrictions on Friday and Sunday, adding to pressures that have pushed the commodity to 12-year highs. Regional sugar prices hit a weekly high on Friday on speculation that Delhi would soon ban exports.

INTELLIGENCE. Export restrictions are harming India’s neighbours – Nepal has an onion shortage; refugees in Bangladesh have had rations cut – but ahead of next year’s elections, Narendra Modi’s government is prioritising inflation over influence. Still, trade restrictions can have unintended consequences. For every consumer wanting low prices, there’s a farmer who doesn’t. One of Modi’s challenges will be to win back agricultural states like Punjab.

FOR BUSINESS. Delhi imposed a 20% duty on parboiled rice exports on Friday and set a $1,200 per ton floor for basmati exports on Sunday. Traders had allegedly circumvented existing non-basmati restrictions by marking exports under these other categories – a sign of the futility of export bans. Other suppliers are unlikely to plug the shortfall. Vietnam and Thailand – the next biggest after India – are at current production capacity due to water issues.

CHINA. Managed decline.

Beijing is letting some over-geared developers fail.

Markets rose on Monday after China halved duties on stock trading and approved affordable housing guidelines. Real estate firm Evergrande was the exception. Its stocks plunged 87% on its first day of trade after a bankruptcy filing.

INTELLIGENCE. Beijing doesn’t want an economic crisis, but it won’t mind a few eggs being broken. Despite worries in the West, China appears on track for growth of at least 5% to the end of 2023. While not the post-COVID recovery many had hoped for, a shake-out of bad debtors should lead to a more sustainable trajectory in the long term. Helping that could be a ceasefire in the trade war. US Commerce Secretary Gina Raimondo began a four-day visit on Sunday.

FOR BUSINESS. As reality dawns that Xi Jinping will not rescue failing developers as his predecessors would have, traders are adjusting to a China that will be less dependent on real estate and infrastructure for most of its growth. With consumer confidence down, many doubt Beijing can manage the transition from an economy based on industry and fixed assets to one based on households and services, but Chinese policymakers are showing few signs of panic.

Written by former diplomats and industry specialists, Geopolitical Dispatch gives you the global intelligence for business and investing you won’t find anywhere else.

TAIWAN. Foxconn in the henhouse.

An anti-independence candidate runs for president.

Technology billionaire Terry Gou said on Monday he would enter the race for Taiwan's 2024 elections. Gou has held rallies recently, saying the only way to avoid war with China was to remove the ruling Democratic Progressive Party.

INTELLIGENCE. Gou, founder of Apple-supplier Foxconn, is more likely to take votes from the opposition Kuomintang, which has twice declined to appoint him as their candidate, than harm the DPP’s chances at re-election. Yet his platform speaks for many Taiwanese who worry that their government has taken its independent-leaning rhetoric too far. On Saturday, Beijing carried out large-scale military drills encircling the island as a response to a US arms deal.

FOR BUSINESS. Taiwan’s economic success has been as much due to its deep trade and investment ties to China as to its democratic character. Foxconn, which has most of its factories in China, is a case in point. Many in the West have welcomed Taiwan’s growing independence movement, but the irony is that this is the factor that will harm Taiwan’s existing autonomy the most. Taiwan’s benchmark rose in Monday’s trade, but Foxconn stocks were lower.

EUROPE. Steps to the right.

Incumbents seek to out-flank the fringe.

French Education Minister Gabriel Attal announced on Sunday the ban of the abaya, a Muslim robe, from schools. Green policies were “insane” and driving Germany to recession, the country’s opposition leader Friedrich Merz said on Sunday.

INTELLIGENCE. European centrists, worried by the far-right’s growing appeal, are adopting populist positions ahead of key elections, including one for the EU’s parliament in 2024. In the wake of a mixed result for Spain’s conservative People’s Party – due to mainstream fears over the potential for a coalition with the reactionary Vox movement – parties like Germany’s Christian Democrats are ruling out any deals with the far-right. They are parroting them instead.

FOR BUSINESS. Not wanting to copy Spain, centre-right politicians in France and Germany are instead taking lessons from Denmark, whose ostensibly centre-left government has long dampened populism’s appeal by adopting hard-line policies on climate and immigration. As such shapeshifting is adopted in more countries, firms should look past traditional left-right stereotypes to determine where a party’s politics and policies truly lie, or where they might go.

With the brevity of a media digest, but the depth of an intelligence assessment, Daily Assessment goes beyond the news to outline the implications.

THE SAHEL. Neighbourhood watch.

More instability in the southern Sahara.

Islamic State had doubled its territory in Mali, a UN report said on Friday. Rebel groups in Chad withdrew last week from a peace pact signed with authorities in 2022. One of the groups had their positions in Libya bombed on Friday.

INTELLIGENCE. Recent coups in Mali, Burkina Faso and Niger have driven out Western forces and given insurgents (and groups like Russia’s Wagner) a vacuum to fill. A similar danger now faces Chad, the last remaining Western ally in Africa’s vast Sahel region. Chad is no democracy – its government is also military-led – but allies like France base thousands of troops there in a fight against Islamist militias. Only semi-stable, Chad faces threats on all its borders.

FOR BUSINESS. If Chad falls, an arc of instability will stretch from the Atlantic to the Red Sea, facilitating an illicit trade in refugees, narcotics and extremist ideology that already threatens Europe’s borders and is driving political polarisation there. Chaos is also impacting Europe’s few but vital regional investments. So far, the coup in Niger has not shut French-owned uranium mines, but on Sunday, the military cut France’s embassy off from power and water.

VANUATU. Trouble in paradise.

Chinese police arrive as a government is declared invalid.

Vanuatu's supreme court on Friday ruled the government had lost confidence after it boycotted a parliamentary vote on a controversial security pact with Australia. Chinese “police experts” arrived on Friday to help “maintain social order.”

INTELLIGENCE. A Chinese security delegation arrived the day of the ruling, driving speculation that a soft coup had been engineered by the Beijing-friendly opposition leader. It was more a public diplomacy exercise, but one the country’s embassy would have enjoyed as a provocation to Vanuatu’s Western partners, particularly one month after French President Emmanuel Macron told a Vanuatu audience to heed the dangers of Beijing’s “new imperialism.”

FOR BUSINESS. While Vanuatu, like neighbouring Solomon Islands, has flirted with closer China ties (and a rumoured military base), it will remain dependent on Australia, which provides most of its aid, tourists and remittances. China may daydream of a military foothold in the South Pacific, but the logistical price would outweigh the strategic benefit. Resource extraction is Beijing’s chief aim. Better options for thwarting US naval dominance lie in the Indian Ocean.

Emailed each weekday at 5am Eastern (9am GMT), Daily Assessment gives you the strategic framing and situational awareness to stay ahead in a changing world.