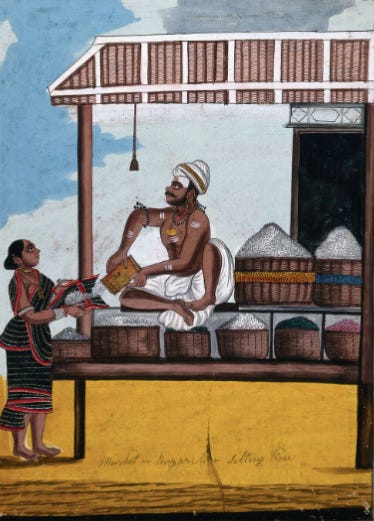

India: Rice gouging.

Also: Ukraine, the EU, China, Thailand, Sweden and the BRICS.

INDIA. Rice gouging.

Delhi’s trade ban will export inflation.

India on Thursday banned the export of non-basmati white and broken rice after domestic retail prices rose 11.15% in 12 months. The move will impact around half of India's total rice exports, which in total account for 40% of global trade.

INTELLIGENCE. The move is a blow to importers, already worried about the effects of higher prices since Russia’s exit from the Black Sea grain initiative. Delhi is taking no chances on domestic food inflation ahead of elections next year. Food prices rose 4.49% in June versus 2.96% in May on the back of heavy rainfall in the north. Trade bans are not uncommon in India, which avoided the price spikes of 2007-08 thanks to export controls.

FOR BUSINESS. African countries, which can least absorb the costs, will be most affected. After Saudi Arabia and Iran, top importers of Indian rice include Benin, Senegal, and Côte d’Ivoire, which already face food insecurity. Prices from Vietnam and Thailand, the next biggest exporters, have meanwhile risen sharply on weather concerns. And with their exports already heading to China and East Asia, it is unlikely that they will be able to divert supplies.

UKRAINE. EUROPE. Wheat and chaff.

Besides the missiles of its enemy, Kyiv is hit by the protectionism of its friends.

Kyiv on Thursday called on the EU to make “maximum efforts” to facilitate grain exports after Moscow continued strikes on Black Sea shipping infrastructure. On Wednesday, five EU countries said they would extend a ban on Ukrainian grain.

INTELLIGENCE. Just when Ukraine needs to send exports west, Bulgaria, Hungary, Poland, Romania, and Slovakia are prioritising their agricultural lobbies, which have complained of cheap Ukrainian grain flooding the market. A blow to European solidarity, the EU has hit back at the moves but will be reluctant to intervene, judging other priorities, including a trade deal with South America, are already too much at risk of being overturned by angry farmers.

FOR BUSINESS. Beggar-thy-neighbour trade policies are proven to harm consumers but proven to win votes. Politics almost always trumps economics so expect more of the same should food prices continue to rise. Strong yields from Australia and Russia, as well as a rebound in exports from Canada will moderate prices, but the arrival of El Niño is already disrupting agricultural forecasts, as well as generating record heat in the northern hemisphere.

Written by former diplomats and industry specialists, Geopolitical Dispatch gives you the global intelligence for business and investing you won’t find anywhere else.

CHINA. Shot in the arm or the foot?

Anticipated stimulus could have unintended consequences.

Further stimulus can be expected, Chinese media said on Friday, after GDP data showed declining growth. Oil prices rose after Beijing said on Thursday it would soon announce a range of measures to support private sector growth.

INTELLIGENCE. Indications of targeted stimulus, which will include a new negative list for investors, expanding the industries they can participate in, is good news for foreign firms. Yet in the long-term, it risks exacerbating one underlying cause of China’s slow growth – high consumer and local government debt. It could also risk the thawing of geopolitical tensions with the US, where recent rapprochement has been driven by a desire to limit economic harm.

FOR BUSINESS. Chinese stimulus further reduces the risk of a global recession, but unless measures can improve productivity and capital allocation they could just defer and enlarge an inevitable reckoning. Stimulus at this point in the cycle, just as inflation in the West comes off the boil, could also exacerbate emerging worries about higher food and energy prices towards the end of the year. Further, it complicates an already tricky balance for central banks.

THAILAND. Moving on.

Democracy appears to give up the fight.

Runner-up Pheu Thai could join conservative parties to form government, analysts said on Thursday. On Wednesday, Thailand's parliament voted against a government led by Pita Limjaroenrat of the election-winning Move Forward party.

INTELLIGENCE. Despite his appeal to voters, 42-year-old Pita Limjaroenrat is feared by the establishment. Having been denied twice by parliament and now under investigation by the courts, Pita has little chance at leadership. After a democratic jolt at the 14 May elections, establishment forces are closing ranks. On Thursday, a teenager was sentenced to 12 months’ imprisonment for wearing a crop top in an apparent impersonation of King Vajiralongkorn.

FOR BUSINESS. Thailand looks set to carry on as an underperforming semi-democracy with a strange king and crony business culture. Hopes of an industrial renaissance look unlikely, but a government under Pheu Thai could surprise, as it did under ThaksinShinawatra, when rural poverty and red tape was dramatically reduced. That said, Thaksin was deposed by a coup in 2006, as was his sister Yingluck in 2014, for going too far on a range of economic policies.

With the brevity of a media digest, but the depth of an intelligence assessment, Daily Assessment goes beyond the news to outline the implications.

SWEDEN. Unholy mess.

Another Koran incident leads to strife.

An Iraqi Christian stomped on a Koran in Stockholm on Wednesday, having burned a copy last month, which almost derailed Sweden’s NATO accession. On Thursday, Iraq expelled Sweden's envoy as protesters stormed the embassy.

INTELLIGENCE. Swedish liberalism has gotten it into diplomatic trouble before, but seldom has it mattered so much. Ericsson has had its licence in Iraq cancelled. Sweden’s NATO bid, agreed by Recep Tayyip Erdogan though yet to be ratified by Turkey’s parliament, is again looking shaky. With the EU Parliament this week quashing talk of Turkish membership, this latest provocation may give Erdogan a fresh excuse to try again for more concessions.

FOR BUSINESS. The reaction in Iraq is more a diplomatic than an economic headache for Stockholm, but should boycotts extend throughout the Muslim world, they could have a material impact on the country’s balance of trade. The bulk of Sweden’s exports go to other EU countries, but the cumulative value of Sweden’s trade with Muslim-majority markets in the Middle East, North Africa and Southeast Asia equalled that of trade with China in 2022.

BRICS. Great walls.

Putin’s travel plans overshadow structural developments.

More than 40 countries want to join the ‘BRICS’ club of emerging markets, Pretoria's chief envoy to the bloc said on Thursday. Moscow and Pretoria said on Wednesday that Putin would not physically attend the BRICS Summit in August.

INTELLIGENCE. Formed by Brazil, Russia, India, China and South Africa, an unlikely acronym has become an unlikelier diplomatic grouping, but the BRICS has become a useful shorthand for the ‘rest’ rising against the ‘West’ in recent years. And though two of its largest members – India and China – have a strained relationship, they share an interest in establishing a multipolar order not dominated by Western rules and norms, whether on trade law or human rights.

FOR BUSINESS. As a strategic forum, the BRICS has the potential to push back on the US and its allies, which have dominated global governance since the end of the Cold War. But as an economic entity, it is less compelling. Talk of a BRICS currency is premature and would unlikely get off the ground. Membership beyond the big five could turn it into a 21st-century version of the Non-Aligned Movement, founded in 1961 and still in search of a purpose.

Emailed each weekday at 5am Eastern (9am GMT), Daily Assessment gives you the strategic framing and situational awareness to stay ahead in a changing world.