India, the US: Political illusions.

Also: Mexico, Ukraine, Russia, NATO, the UK, China and Israel.

INDIA. UNITED STATES. Political illusions.

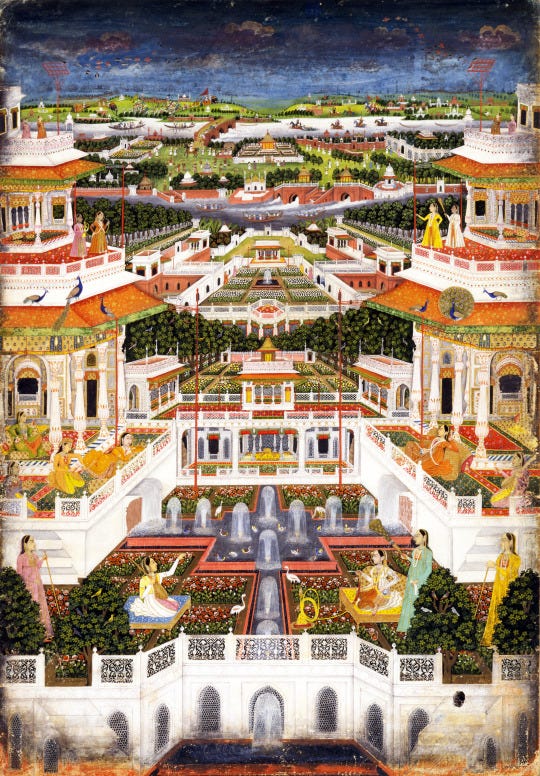

Joe Biden may have a dreamlike vision of India.

India and the US declared themselves “among the closest partners in the world” in a joint statement on Thursday. Indian imports of Russian oil hit a record 1.95 million barrels per day in May, according to data seen by Reuters on Wednesday.

INTELLIGENCE. Joe Biden gave Narendra Modi an almost obsequious welcome, but the visit’s gloss and deals on technology, defence and trade may not alter Delhi’s relationship with Moscow or give Washington a counterweight to Beijing. India won’t likely substitute its reliance on Russia for more expensive American arms. And as France, with its Rafale and aptly named Mirage fighter jets, has demonstrated, defence sales to India are seldom straightforward.

FOR BUSINESS. China’s GDP is five times larger than India’s and its military spends 350% more. Neither Delhi would likely come to Washington’s aid on Taiwan, nor would Washington want to be involved in a Sino-Indian war. At the margins, India is diversifying its military imports and the US is diversifying its supply chains, but we are yet to witness the creation of a new superpower dyad in the league of the US-China relationship that emerged after the Cold War.

MEXICO. UNITED STATES. Lost in the maize.

Bilateral risks remain beneath the surface.

The Department of Homeland Security launched two operations on Thursday to counter fentanyl trafficking at the Mexican border. Mexico's president said on Monday he would sign a pact with tortilla makers to only use non-GM corn.

INTELLIGENCE. Since Washington's border restrictions in May, US-Mexico tensions have eased. Nearshoring, led by Tesla, is driving record investment. The peso is at a seven-year high to the dollar. Modelo Especial is now America's top-selling beer. But flashpoints remain. Ahead of elections in both countries next year, drugs and crime remain in focus. Added to this now is a dispute over genetically modified corn, for which the US is Mexico’s top supplier.

FOR BUSINESS. Corn is totemic for both countries. The US’s top-producing state, Iowa, is in drought and has outsized sway, with the Republican primaries to begin there in the new year.Mexico’s president is seeing much of his agenda overturned by the courts,with another blow on Thursday. Appealing to Mexico’s sacred grain is a way to secure a larger majority for his party, which has a strong indigenous base. The way to voters’ hearts is through their stomachs.

Written by former diplomats and industry specialists, Geopolitical Dispatch gives you the global intelligence for business and investing you won’t find anywhere else.

UKRAINE. RUSSIA. Burning bridges.

The Kremlin issues fresh warnings to the West.

Russia said on Thursday a Ukrainian attack damaged a bridge connecting Crimea. Earlier in the week, Russia's defence minister warned that strikes on Crimea using US or British weapons would embroil Washington and London in the war.

INTELLIGENCE. It is unlikely a strike on the Chonhar Bridge would have been possible without Western missiles, but Kyiv and its backers have not responded to Moscow’s claims. The Kremlin has grown more strident in its rhetoric in recent weeks. On Thursday, the former director of the Carnegie Moscow Center, Dmitri Trenin, said Russia needed to put the “nuclear bullet” into the “revolver drum” the US was playing with, so as to properly deter Western escalation.

FOR BUSINESS. Russia will only use nuclear arms as a last resort, which on present trends remains remote. Outlasting Western supplies and resolve remains the favoured gambit. While avoiding nuclear winter is good for the global economy, grinding attrition is not. Unless peace is brokered, the conflict could last for years. In the meantime, Kyiv is engaging in escalatory rhetoric itself. On Thursday, it claimed Moscow was planning a nuclear radiation leak.

UKRAINE. NATO. Building offramps.

Hints of a diplomatic solution emerge.

Germany's chancellor said on Thursday that Ukraine's membership of NATO was "out of the question" for now. Paris is considering giving Kyiv membership in exchange for it sitting down with Moscow, Le Monde reported on Tuesday..

INTELLIGENCE. The Le Monde report looks like a French trial balloon and would match previous attempts Paris has made to broker a settlement between Moscow and Kyiv. Getting other NATO partners to agree, let alone Ukraine, would need deft footwork, but a conference in Denmark this weekend between a range of players across the Russia-Ukraine spectrum could be the venue for initial discussions. Formal peace talks in Paris are rumoured for next month.

FOR BUSINESS. The alternative to negotiations, however distasteful, is a long, grinding war that nobody wins. Firms, however, should not jump at rumours. Positions in Moscow and Kyiv are hardening and even if talks were to commence it is likely they would take time. The arguably more straightforward US-Taliban agreement took over a year to negotiate and then it took a further 18 months before allied forces finally withdrew from Kabul.

With the brevity of a media digest, but the depth of an intelligence assessment, Daily Assessment goes beyond the news to outline the implications.

UNITED KINGDOM. CHINA. Straitened times.

Beijing shows ire on overtures to Taipei.

China and the UK had a common responsibility to “shun group politics and bloc confrontations”, China Daily said on Thursday. Beijing's deputy UN envoy said on Tuesday China “firmly supported” Argentina's claim to the Falkland Islands.

INTELLIGENCE. Beijing is giving London a slap after last week’s meeting between Tom Tugendhat, Britain's security minister, and Taiwan's minister for digital affairs, breaking a Westminster convention that only junior ministers engage with Taipei. China’s position on the Falklands is not new, but as with recent messaging to the US on Cuba, Beijing wants to let the West know how it feels about Taiwan in geographic terms the West can fully understand.

FOR BUSINESS. Despite its ties to Washington and the Royal Navy’s recent East Asia patrols, London is repairing ties with Beijing, which hit a nadir in 2020 over Huawei and Hong Kong. Foreign Minister James Cleverly said Tuesday he was looking at visit options, and firms from HSBC to Rolls-Royce are bullish on relations. But as with all policies, the risk is that Conservative Party fractures could get in the way. Tugendhat is a China hawk and leadership aspirant.

ISRAEL. CHINA. An eye for an eye.

With escalating tensions in Palestine, China sees an opportunity.

Israel on Thursday killed three militants in an airstrike near Jenin and demolished the home of a Palestinian suspected to have killed a soldier. On Wednesday, settlers attacked Palestinian villages after four Israelis were killed on Tuesday.

INTELLIGENCE. Since an Israeli raid on Monday, which killed seven Palestinians, including two teenagers, violence in the West Bank has increased, leading to the cancellation of ministerial meetings by Morocco and the alleged suspension of Israeli Hajj flights by Saudi Arabia. Washington condemned the violence but is cautious about further aggravating Israel’s fractious coalition politics amid rumours of US-Iran rapprochement talks, which Israel opposes.

FOR BUSINESS. With a distracted US, an unstable Israeli government, and proxy militias seeking to enhance Iran’s leverage, peace in Palestine looks untenable. Enter China, which has less baggage and more tolerance for risk. Fresh from brokering detente between Tehran and Riyadh, Beijing hosted Palestine’s president on 14 June. Mediation was allegedly offered. Even if it doesn’t succeed, the mere attempt will enhance China’s reputation – and economic sway.

Emailed each weekday at 5am Eastern (9am GMT), Daily Assessment gives you the strategic framing and situational awareness to stay ahead in a changing world.