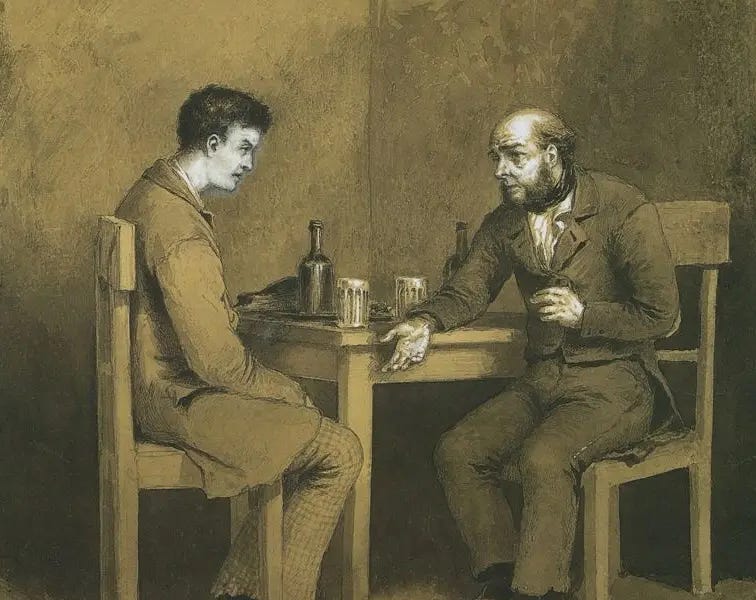

North Korea, Russia: Thick as thieves.

Also: Ukraine, China, Southeast Asia, the DRC and climate change.

NORTH KOREA. RUSSIA. Thick as thieves.

Kim and Putin head to Vladivostok.

North Korea’s Kim Jong Un will visit Vladivostok this month to meet Russia’s Vladimir Putin, the New York Times reported on Monday. Vladivostok’s Far Eastern University will host the 8th Eastern Economic Forum on 10 September.

INTELLIGENCE. Putin will skip this year’s major summits – the G20, the East Asia Summit, and APEC – but he is happy to meet counterparts willing to meet him, if it can be stage-managed. For Kim, who usually meets nobody, it is an opportunity to show North Korea’s (relative) re-opening as he crosses the border by armoured train. The two sides will reportedly ink a new weapons deal, bringing them closer together, but further apart from everyone else.

FOR BUSINESS. Russia continues to pivot its economy eastwards. Few foreigners other than Kim will make the trek to Vladivostok, but Asian traders are happy to exploit the gaps the West has left. China’s exposure to Russian banks quadrupled in the 14 months to March, the Financial Times reported on Monday. And while oil exports to India have eased, broader links have deepened. Last week, the US applied its first sanctions on Indian firms trading with Russia.

UKRAINE. RUSSIA. Grainy picture.

Moscow rebuffs a return to Black Sea exports.

Vladimir Putin on Monday said Russia would not return to the Black Sea Grain Initiative unless the West decreased sanctions. Recep Tayyip Erdogan said he hoped to broker a deal, adding that Kyiv would need to “soften its approach.”

INTELLIGENCE. Russia is happy to drag this out. Higher grain prices hurt its remaining allies but increase its leverage. Greater export earnings, moreover, help stabilise a ruble that’s hit 17-month lows. Russia is also happy to extend its war with Ukraine. Despite recent advances by Kyiv, its counteroffensive has only retaken 108km2 of land – less than Disney World Florida. The US is eyeing yet more weapons to break the impasse, including depleted uranium.

FOR BUSINESS. Despite Erdogan’s best efforts, it is unlikely the Black Sea deal will resume unless Putin can score major concessions, whether that’s from the West and Ukraine, or Turkey in other areas (for instance in Syria or the Caucasus). Putin said Moscow is otherwise weeks away from providing free grain to Burkina Faso, the Central African Republic, Eritrea, Mali, Somalia, and Zimbabwe. Russia has also brokered a major commercial export deal with Egypt.

Written by former diplomats and industry specialists, Geopolitical Dispatch gives you the global intelligence for business and investing you won’t find anywhere else.

CHINA. Making advances.

Chinese technology is catching up.

Technology analysts on Monday said Huawei's latest smartphone included 7-nanometer chips. Chinese researchers last month said they had discovered a new sensor technique that could challenge US submarine operations.

INTELLIGENCE. Beyond chips and AI, the US is most worried about China’s progress in military technology. Should Beijing's terahertz-based detection technique be proven, cutting-edge US vessels, such as the Virginia-class submarine, could see their stealth advantages made redundant. China’s claims are hard to verify, but could raise new challenges to pricey submarine procurement programs such as Washington’s AUKUS arrangement with Australia.

FOR BUSINESS. China's SMIC, which developed Huawei’s chips, is unable to produce the 3nm nodes only Taiwan's TSMC and Korea's Samsung can work with, but it's seemingly not far behind despite Western sanctions. The US wants stabler ties, but such mini-Sputnik moments will only give hardliners cause to seek stronger trade measures from Washington and allies. The Dutch, which make chip production machines, began new controls on Friday.

SOUTHEAST ASIA. Mind your own business.

ASEAN is better on trade than foreign affairs.

Indonesia's foreign minister implored her counterparts on Monday to “prove ASEAN still matters” as the regional club struggles to find consensus on Myanmar or the South China Sea. ASEAN on Sunday began talks for a digital trade deal.

INTELLIGENCE. The Association of South East Asian Nations has stopped inter-state wars in the region, but has little coherence. Its members range from the democratic (e.g., Singapore, which held presidential polls on Friday), to the ambivalent (e.g., Thailand) and autocratic (e.g., Laos and now Myanmar). It is also struggling to play the role of regional convener, with this week’s East Asia Summit to be missed by the presidents of the US, China and Russia.

FOR BUSINESS. The ‘ASEAN Digital Economy Framework Agreement’ could build a $2 trillion regional technology ecosystem. Southeast Asia is home to some of the world’s most promising start-ups, but lacking the scale or regulatory heft of China, the US or Europe, its countries must seek capital, technology and standards from elsewhere. Singapore has pioneered the ‘digital FTA’ model, having signed deals with the UK and South Korea among others.

With the brevity of a media digest, but the depth of an intelligence assessment, Daily Assessment goes beyond the news to outline the implications.

DEMOCRATIC REPUBLIC OF THE CONGO. Widening rift.

Violence increases in another conflict zone.

The estimated death toll from anti-UN protests in the eastern DRC rose to 100, according to media reports on Monday. The army is accused of massacring members of a church in Goma, near the Rwanda border, last Wednesday.

INTELLIGENCE. A religious sect called the Messiahans was planning demonstrations against UN peacekeepers before Congolese soldiers attacked. It will only deepen a paranoia that has seen both a rise in ethnic violence and religious extremism across the East African Rift. Far from Kinshasa, Goma and the North Kivu province have been the scene of numerous conflicts in recent decades. The DRC has around 6 million internally displaced persons.

FOR BUSINESS. Goma is also far from Katanga, where most of the DRC’s copper, cobalt and uranium is found, but it is close to Rwanda and Uganda, which have a per capita GDP twice the DRC’s and have been greatly destabilised by militias operating nearby. It is also home to artisanal gold works and a power vacuum that has fuelled Islamic State fighting as far south as Mozambique. Even in the remote African highlands, the world is surprisingly interconnected.

CLIMATE CHANGE. Prior preparation.

Positions are readied before the UN’s next Conference of Parties.

Kenya opened Africa’s first climate summit on Monday, welcoming UAE investors who pledged to buy $450 million in carbon credits. The EU will seek a fossil fuel phaseout at November's COP28 meeting, drafts seen on Friday suggest.

INTELLIGENCE. The EU will struggle to get developing countries to phase out oil and coal while countries like Germany go backwards on clean energy. Cross-regional positions, such as in Africa, will also ensure stronger leverage in negotiations, which this year are due to be held in carbon-rich Dubai. Global fossil fuel demand is estimated to peak around 2030, according to the UN. The problem is that such forecasts tend to be pushed out.

FOR BUSINESS. Few expect a breakthrough at COP28, but growth in the carbon offsetting sector could lead to new market rules being established and a larger role for business. Still, even the best deals are subject to risk. Until they were felled this year by a coup and gang-fuelled instability respectively, Gabon and Ecuador were two of the biggest promoters of carbon schemes. Other projects, from Peru to Malaysia, have been accused of greenwashing or fraud.

Emailed each weekday at 5am Eastern (9am GMT), Daily Assessment gives you the strategic framing and situational awareness to stay ahead in a changing world.