Week signals: Panda and bear

China and Russia, plus France, Iran, Israel, the US, and Japan.

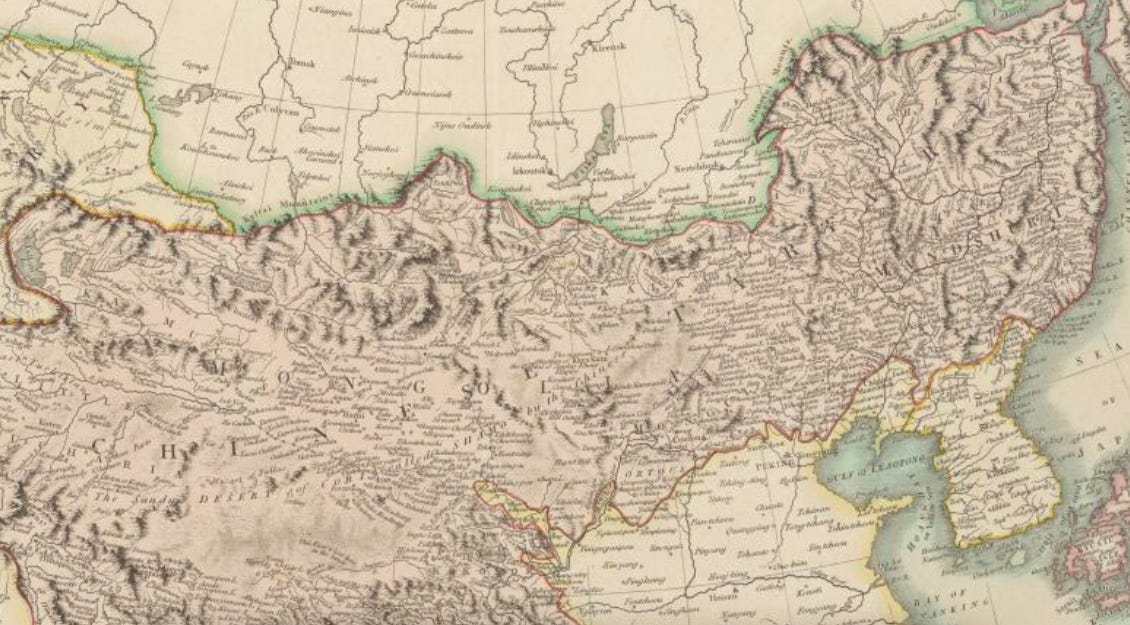

The Week in Review: China and Russia

Earlier this week, one of our readers, Dimitri Zabelin of the excellent Pantheon Insights, invited me onto a Twitter Spaces talk on Europe, NATO, and more (listen to the recording here). We didn't dwell on Russia, but it got me thinking about the topic of today's Week in Review: Vladimir Putin's defence deal with North Korea's Kim Jong Un.

We may never know the finer details of the agreement, which otherwise includes broad language on mutual assistance like in NATO's Article V, but it has shaken global norms around non-proliferation and UN sanctions enforcement, considering that – until recently – even Moscow agreed Pyongyang was a rogue regime, with its weapons of mass destruction posing an unacceptable threat to regional stability.

The agreement may have also shaken Russia’s relationship with China. It would be hard to believe Xi Jinping wasn’t informed of Putin’s plans. Xi had only recently hosted his “dear friend” to a visit with as much pomp and circumstance. Yet Moscow has acted with bad faith before. Most recently, it was (China might claim) the decision to launch the war in Ukraine straight after the Beijing Winter Olympics. More significantly, it was Leonid Brezhnev's 1968 declaration that any deviation from socialist orthodoxy would justify Soviet intervention, as happened in the Prague Spring. Mao Zedong read this as a potential threat to his Cultural Revolution. It subsequently led to a 1969 border war and China's 1972 turn to the US.

North Korea remained on the side of the USSR during this time and while China became the DPRK’s chief sponsor after the Soviet collapse, there has always been a distrust between Beijing and Pyongyang. It’s unlikely that Putin wants to engineer another Sino-Russian crisis, or resuscitate an ancient enmity predating any disagreements Moscow has with the West, but he is perhaps reminding Xi of three things as they look to negotiate the next stages of their economic enmeshment, which could range from a shared financial architecture (sanctions-proofed from the West) to a common energy network (out of range of the US Navy).

The first is that Russia has options beyond China, and that its strategic autonomy is also desired by most of China’s so-called friends. While North Korea, Vietnam, Laos, Cambodia, and many of the Central Asian ‘stans share China’s autocratic tendencies, they are just as unwilling to exist under Chinese suzerainty as any US ally. Better to have other poles of influence to which to pivot.

The second is that Russia is willing to break things. Like Russia, China mouths the UN Charter when discussing its interests, but unlike Russia China still largely adheres to it. Whereas Russia ran roughshod over sovereignty in Ukraine, China at least attempts to couch its claims to the South China Sea in legalese. Perhaps this is a matter of weakness, but more likely it’s a matter of Xi’s more cautious personality, as well as China’s greater integration with the West.

The third is that Russia is upset China hasn’t been more helpful on Ukraine. Many in the West consider China’s assistance incontrovertible, but unlike North Korea (or Iran, or Belarus) it has so far avoided direct military aid, and many if not most of its large businesses have sought to ensure any dual-use goods don’t end up in Russian weapons. And while many of these goods have ended up on the battlefield, so have US-designed chips and European components. Until recently, Taiwan was Russia’s biggest supplier of machine tools. China, meanwhile, has been Ukraine’s largest supplier of drones.

Does this all mean a break in the incipient China-Russia alliance? Far from it. The mutual interests and common adversary are too great. And it’s notable that Beijing has officially welcomed deeper Moscow-Pyongyang ties (even if its comments have been relatively guarded). But both sides have significant differences. These are worth bearing in mind whether you’re in the Pentagon, the markets, or trade.

The Week Ahead

FRANCE. Watch for musical chairs

It's become increasingly clear that Emmanuel Macron's decision to call a snap legislative election could backfire. His Ensemble coalition is consistently coming third in the polls. This could lead to new declarations of allegiance to his opponents as Macron’s erstwhile supporters inside and beyond the Assembly decide on which is the lesser evil: a government beholden to the far right or the far left. The weight of these endorsements (or defections) could determine whether National Rally can achieve a majority.

IRAN. Watch for disappointment

Iranians elect their next president Friday, from an approved shortlist of six. All are conservatives or hardliners, except for former health minister Masoud Pezeshkian, who appears to have more liberal views on women and Iran’s engagement with the West. Many are getting excited about Pezeshkian, who ran in 2013 and 2021, particularly as the other five will presumably split the pro-regime vote. But don't expect a clear path for this ethnic-Azeri outsider. And even if he wins (unlikely) don't expect dramatic change.

ISRAEL. Watch the Lebanese border

A war with Hezbollah isn’t certain, but it’s possible. After consistent shelling since October, and amid speculated escalation, here are three risks to watch. The first is if Israel strikes Lebanese infrastructure, not just Hezbollah positions. This could pre-empt a wider conflict. The second is a cross-border raid by Hezbollah. This would have limited strategic effect, but reminders of Gaza would be impossible for Israel to ignore. The third is an attack on, or retreat by, UN or Lebanese government forces, leaving a hole only Hezbollah (or Israel) could fill.

UNITED STATES. Watch for gradual consensus

Thursday will see the election's first debate. Previous rounds were notable for their discord and this one won’t disappoint. It will likely sway few. Both sides will claim to win. Many, if not most observers, will be appalled. Unless Trump has a lobotomy, or Biden gets younger, the focus on personality over policy will intensify. This will overshadow subtle signs of gradual consensus, including the candidates' growing similarities on issues such as migration (Biden on tougher borders; Trump on student green cards).

JAPAN. Watch for yen volatility

So many have tried to defy the Bank of Japan it's known as the 'widow-maker' trade, but the yen has become so weak in recent months the US has now added Japan to its watchlist of currency manipulators. A weak yen is causing other problems, from Mt Fuji-blocking tourists to the novelty of inflation, but the BoJ has said it won't intervene, unless to smooth volatility, which suggests volatility could be in the offing. Coupled with a government holding a 16% approval rating and ongoing debt concerns, the risks loom large.

Michael Feller is Chief Strategist at Geopolitical Strategy. LinkedIn.

(Please note none of this is investment advice).